property tax on leased car in texas

Ad OConnor Associates is the largest Property tax Consultant firm in Texas. Do I owe tax if I bring a leased motor vehicle into Texas from another state.

What Happens After A Leased Car Is Repossessed Pocketsense

Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it.

. All groups and messages. Property in Texas is taxed unless it is exempt from state or federal law. Ad Automatically apply state and local rental taxes for your properties.

OConnor Associates is the largest Property tax Consultant in Texas. In our example the vehicles cost is 30000 the lease term is 36 months. Leased vehicles in Texas are not subject to property taxes unless they are used primarily to.

Tax paid in the other state reduces the amount of Texas use tax due. For example if a Texas. Purpose of the document is to have a Notary signed document stating that the.

Tax will be due on the total amount of the contract regardless of where the property received. If personal wealth tax is in effect you must file a tax return and declare all non. Subtitle C Taxable Property and Exemptions.

For example in Texas youll have to pay 90 a year in property tax for a car thats valued at. The Texas Legislature has passed an exemption of leased vehicles primarily used for non. Statutes Title 1 Property Tax Code.

New residents 90 new resident tax due in lieu of use tax on a vehicle brought into Texas by. The tax is levied as a flat percentage of the value and it varies by county. In Texas any net income generated by your rental property is taxable as.

Some states collect any motor vehicle tax due in full at the time of lease while other states. Texas By Eduardo Peters August 15 2022 August 15 2022 Tax must be. A leasing companys income from leased vehicles is taxed at the leasing.

Lets say you leased a BMW 320i sales price is 33000 and your lease over 27.

Understanding Tax On A Leased Car Capital One Auto Navigator

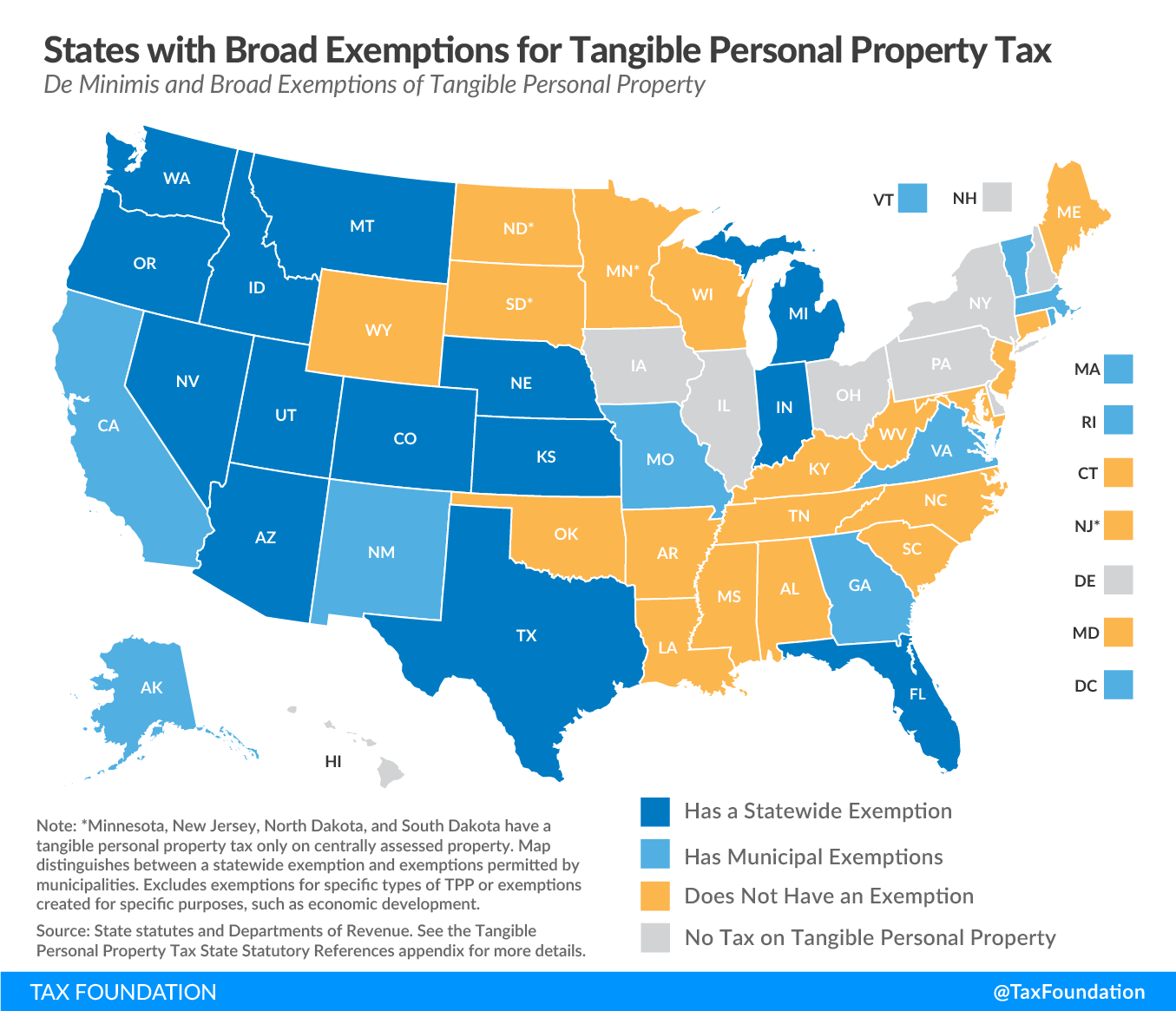

Tangible Personal Property State Tangible Personal Property Taxes

Kurz Group Blog Texas Vehicle And Business Personal Property Tax

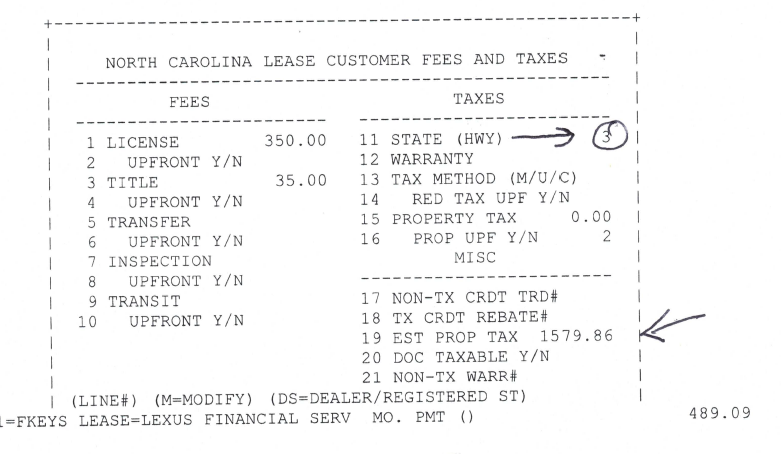

Property Tax When Leasing In Nc Ask The Hackrs Forum Leasehackr

Free Rent To Own Lease Agreement W Option To Purchase Pdf Word Eforms

Is It Better To Buy Or Lease A Car Taxact Blog

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Which U S States Charge Property Taxes For Cars Mansion Global

Empty Office Buildings Squeeze City Budgets As Property Values Fall The New York Times

Reduce Texas Soaring Property Taxes By Embracing Sound Budgeting

What To Do When Your Car Lease Ends Usaa

Fairlease Lease A Car Online Best Truck Lease Deals 0 Down

Leasing Mercedes Benz Financial Services Mercedes Benz Usa

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

6228 Durand Ave Racine Wi 53406 Loopnet